News

15 years Finreon: Building bridges between finance research and asset management

Today marks a special milestone for Finreon: we are celebrating 15 years of milestones, creative solutions and trusting collaboration! What began in 2009 as a spin-off from the University of St.Gallen is now an established and competent partner when it comes to innovative investment concepts in the field of asset management and investor advisory. Our special thanks go to all our clients who have been with us for 15 years and have placed their trust in us, to our partners who enable us to offer customized solutions and, of course, to our fantastic team, whose commitment and expertise form the foundation of our success.

Finreon wins LSEG Lipper Fund Award 2024 in the 'Bond USD' category

Over the last 5️ years, the Finreon Fixed Income Risk Control® USD Aggregate Fund has outperformed its Swiss competitors in the 'Bond USD' category & has been crowned the best fund. The unique approach to managing interest rate and credit risks has once again prevailed and underlined the importance of risk control. Especially in the difficult phase of rising interest rates in 2022, duration management using the Finreon interest rate risk indicator was able to deliver great added value.

Find out more about our Finreon Fixed Income Risk Control® solutions

Finreon joins Climate Action 100+ initiative

By taking this significant step, we join a leading group of asset managers and asset owners working together to engage and improve the sustainability practices of the world's largest carbon emitters. Joining Climate Action 100+ is perfectly aligned with our engagement approach for carbon-intensive companies, which we have implemented since January 2023.

Joining Climate Action 100+ means that we are now working with other signatories on company-related commitments and thereby further expanding our influence. Together with other investors, we are committed to a constructive exchange to shape a more sustainable future.

Learn more about Climate Action 100+

Learn more about our Finreon Engagement Pool

Finreon receives 2nd star in FNG label

Just one year after being awarded the FNG seal for the first time, our fund has been honored with a second star. With two stars, the Finreon SGKB Carbon Focus Fund is therefore one of the most sustainable investment solutions. The FNG seal is the quality standard for sustainable investment solutions in German-speaking countries. Compared to the previous year, the fund stood out in particular with its "innovative concept as part of the systematic engagement strategy". Our efforts in the area of a strictly sustainable selection strategy and the quality of our reporting were also rated positively compared to the previous year.

Find out more about the Finreon Carbon Focus investment concept here

Filmprojekt: GrüeziFinreon

The GrüeziFinreon film project is here! Set against the picturesque backdrop of Lake Zurich and in close proximity to the Swiss mountains, Finreon bridges the gap between customer needs and the latest innovations in the financial industry. These three videos provide an insight behind the scenes. What is the recipe for success? What is their investment strategy and where do they draw their inspiration from? Stay tuned and join us on our journey.

New launch: Finreon Green Income Fund

The time has come. After more than two years of development, we can announce the successful launch of the "Finreon Green Income Fund" to harvest volatility premiums. The Finreon Green Income Fund innovatively combines the harvesting of volatility premiums with a sustainable green bond underlying portfolio. The risk-controlled volatility strategy features robust return/risk characteristics and is designed to provide steady returns.

New Paper on Carbon Accounting by Finreon

In its new paper “Avoiding greenwashing in investment portfolios through consistent emissions classification and transparent reporting of derivatives”, Finreon identifies three key elements that need to be considered in order to avoid greenwashing in investment portfolios.

Is now a good time to invest in bonds?

The US Federal Reserve has just raised its interest rates to the target range of 5.00-5.25%. We may have reached the peak of the current rate hike cycle. It would be the 12th cycle since 1962 to come to an end. What can bond investors learn from this historical experience? Is now a good time to (re)enter the market?

Finreon in UniversalSelect Magazine

How can Finreon exert sustainable pressure on companies through equity investments to drive a change to sustainable business? In this interview, Dr. Ralf Seiz explains three different ways in which this can be achieved. He also goes into more detail about the Finreon SGKB Carbon Focus strategy.

Universal Champions Call

The time has come! This Thursday, April 27th, we will present our new sustainable volatility strategy to a larger audience for the first time: FINREON GREEN INCOME®.

The volatility strategy has been developed over the last two years according to the latest methodologies and allows for the first time to capture the volatility premium in a sustainable Art. 8+ UCITS fund. Investors who are involved from the beginning benefit from exceptionally attractive fees and there is even the possibility to secure a low pricing "forever". The next weeks we will be on a big presentation tour in Germany, Austria and Switzerland.

Over EUR 100 million in the new Carbon Focus Solution

The next milestone after a short time.

We are very pleased to celebrate the success of the joint solution with St.Galler Kantonalbank Deutschland AG. After one year live with the Finreon SGKB Carbon Focus Fund, we cross the threshold of EUR 100 million in assets under management. Also worth mentioning is the thus decarbonized volume of over EUR 1 billion. A big thank you also goes to our partner Universal Investment for the trustful and professional cooperation.

Read the fund details here

Finreon receives the FNG seal

It was with great pleasure and pride that we received the FNG seal for the Finreon SGKB Carbon Focus Fund on November 24, 2022. Together with St.Galler Kantonalbank, the fund was launched in January 2022. The FNG seal is the quality standard for sustainable investments. One of the core tasks of the FNG is to further develop and improve financial investments in order to ensure the quality of sustainable investment products. The fund is characterized in particular by its rigorous selection and construction process, its special sustainability strategy and its high level of transparency. In addition, the role of sustainability in our company, as well as its ESG know-how and institutional credibility, stood out positively in the evaluation process.

Read the media release here. (only in German)

The Ukraine War and the Energy Supply Crisis

Russia may have accelerated the world's energy transition against its will - A paradoxical and positive consequence for the climate of the Russian invasion of Ukraine is the trend in global greenhouse gas emissions, which are expected to reach a "peak" from 2025. The main reason is the increase in investment in sustainable energy due to the "profound rebalancing" of global energy markets, according to the International Energy Agency (IEA).

Read the full articel here (only in German)

Finreon at DAS INVESTMENT

DAS INVESTMENT is a financial magazine and reports about many interesting topics in the field of finance. From now on we have the opportunity to present ourselves on the microsite of Universal with our company profile and especially our new solution in cooperation with St.Galler Kantonalbank Germany, Finreon SGKB Carbon Focus®.

Discover our profil here.

Decarbonization of the portfolio is the investment goal

Our CEO Dr. Ralf Seiz and Christoffer Müller from St.Galler Kantonalbank Deutschland AG, explain in an interview with Jan Richter, analyst at FONDSCONSULT, the concept of the new Finreon SGKB Carbon Focus Fund and how the fund can reduce the CO2 footprint of the portfolio.

Read the interview here.

Cooperation with University of Zurich and ETH Zurich

We are very excited about our new collaboration with the Master in Quantitative Finance at the University of Zurich and ETH Zurich. As bridge builders, we call for exchange between academia and practice.

Learn more about the collaborations of our new partners here.

Refinitiv Lipper Fund Award 2022 Switzerland

It is with great pleasure that we inform you that Finreon, in cooperation with St.Galler Kantonalbank (SGKB), has once again won a Lipper Fund Awards 2022. The official event for the awards was cancelled this year. Nevertheless, the success was celebrated on a small scale between Finreon and SGKB.

Podcast St.Galler Kantonalbank Deutschland

"We need to move from a Brown to a Green Economy," says Dr. Ralf Seiz in an interview with Sven Thielmann. The new podcast episode of St. Galler Kantonalbank Deutschland AG explains the need for a lower CO2 structure and how decarbonizing portfolios actually works.

The innovative Finreon SGKB Carbon Focus combines a global equity portfolio with a patent-pending strategy that establishes a short position against companies with a high carbon footprint. It thus enables hedging against CO2 risks and aims to neutralize the CO2 footprint of portfolios.

Feel free to listen in here.

CAPinside congress 2022

The topic of ESG has preoccupied the fund industry for many months. A process that has led to a rethink in capital investment.

At the two-day CAPinside congress in Hamburg, exciting roundtables, panel discussions and key note speeches were held on the topic of "how to use the new ESG rules for consulting". In his presentation "Portfolios in (Climate) Change", Dr. Ralf Seiz showed how simple, flexible and cost-effective reduction of the carbon footprint of investment portfolios works. In the exchange with family offices, administrators and consultants, this congress in a closed circle helped to achieve a better understanding with concrete exchange and exciting presentations.

Macroeconomic Update

The high inflation figures in the USA have prompted the Fed to rethink its policy. The unprecedented quantitative easing program is therefore being ended in rapid steps. Key interest rate hikes are on the cards. This monetary policy normalization also means a return to economic reality. This is a challenging environment for bond investors. Dynamic managing interest rate and credit risks can help. We show you how and why this will help you get through the new bond year 2022 successfully.

Continue to the macroeconomic Update (only in German)

Finreon donates to the Kinderkrebshilfe Switzerland

We are supporting Kinderkrebshilfe Schweiz with a donation for this year's Christmas. Kinderkrebshilfe Schweiz is a non-profit organization and one of the first places to go when it comes to the topic of children and cancer. As an association, they accompany, care for and help affected families. With our donation to the Kinderkrebshilfe we would like to support the children and the families.

Richmond PIMS Forum 2021

Finreon was present at this year's Richmond PIMS Forum in Bad Ragaz. During two days financial experts and investors meet for seminars, workshops and one-to-one meetings. An all-around exciting conference with the goal to provide senior industry professionals with access to new ideas, solutions and innovations.

Continue to the Richmond PIMS Forum

Private Wealth Excellence Forum

The Private Wealth Excellence Forum is a top-class networking event for family offices and took place this year on November 8 and 9 in Frankfurt. Finreon was represented at the event during both days. The program of the event was characterized by a strong practical orientation and high thematic relevance. In addition to keynote presentations, the participants had the opportunity to discuss individual project plans and solutions during the selected one-on-one meetings.

Continue to the Private Wealth Excellence Forum

Finreon Flash

In the current Finreon Flash, we show that risk management using the Finreon Tail Risk Control® strategy has resulted in an 11% increase in assets for a typical Swiss pension fund over the last 10 years. You can read more about this on the following two pages.

Continue to the Finreon Flash

UHLENBRUCH 24th Annual Portfolio Management Conference

Finreon was a guest at this year's 24th Uhlenbruch Annual Conference on Portfolio Management. The two-day event on September 21 and 22 was characterized by interesting and top-class presentations. The event was complemented by a diverse professional and personal exchange with the attending institutional investors.

Continue to the Uhlenbruch Annual Conference on Portfolio Management

Performance Finreon Fixed Income Risk Control® USD Aggregate Fund

Finreon is pleased to announce that the Finreon Fixed Income Risk Control® USD Aggregate Fund, launched in June 2018, now has a 3-year track record and ranks first in its peer group "Bonds USD Diversified" in terms of return and return/risk. With an absolute performance of +18.0% (CHF-hedged), the fund clearly outperformed the benchmark Barclays US Aggregate (+9.6%).

Read the fund details here

Launch AMC Nachhaltigkeits-Champions

We are very pleased about the successful launch of the "AMC Sustainability Champion" in cooperation with the Glarner Kantonalbank. Read more information about the Actively Managed Certificate with neutral CO2 exposure here:

Academic Lunch Seminar: The Show Must Go On

On August 25, the tenth academic lunch seminar took place at Haus zum Rüden. In the two keynote speeches we showed how the asset class equities can be assessed in the current economic environment and to what extent a targeted rebalancing can help to bring opportunities and risks back into balance.

Finreon in the Absolutlspezial Equity magazin

We are very pleased to appear in the Absolutlspezial Equity magazin with the article "Zweistufiger Ansatz zum Aktienrisikomanagement" in which the attractiveness of equities as an asset class continues to increase due to the current low interest rate environment. However, equities carry a risk of large declines in value. Simon Mueller and Julian Wössner of Finreon divide the risk for value losses into two types and show how an investment portfolio can be protected against asset losses through two complementary risk management approaches.

Read the article in Absolut report here (only available in German)

Finreon is a member of Swiss Sustainable Finance

Since summer 2021, Finreon AG has been one of the approximately 180 members of Swiss Sustainable Finance. As a member of the SSF, we strive to strengthen the further development of sustainable financial products and promote solutions to combat climate change within the financial industry. Our goal is to drive innovative solutions by bridging the gap between research and practice.

Is inflation coming now? Background, scenarios and effects on debt sustainability and markets

On Wednesday, July 7, the annual joint customer event together with Acrevis took place. Dr. Ralf Seiz (CEO, Finreon) and Dr. Alexander Gruber (Head of Economic Research and Advisory, Finreon) presented as guest speakers on the topic "Is inflation coming now? Background, scenarios and implications for debt sustainability and markets".

Finreon in the current edition of Absolut|report

A two-tiered approach to equity risk management. The attractiveness of equities as an asset class continues to increase due to the current low interest rate environment. However, equities carry a risk of large losses. In the June 2020 edition of Absolut|report, we divide this risk into two types and show how an investment portfolio can be protected against losses by two complementary risk management approaches.

Read the article in Absolut report here (only available in German)

Portfolios in (Climate-) Change

To mitigating climate change Swiss pension funds will have to make their contribution by decarbonizing their investment portfolios. By taking market-based approaches one step further, they can achieve tomorrow's climate targets today.

Read the article by VPS, Schweizer Personal Vorsorge, on the topic of "Portfolios in (Climate) Change" here (only available in German and in French)

Refinitiv Lipper Fund Award 2020 Switzerland

It is with great pleasure that we inform you that Finreon has won two Lipper Fund Awards 2020 in cooperation with St. Galler Kantonalbank (SGKB). The awards were presented to representatives of the two partners on Wednesday, February 26, 2020, during the official Refinitiv Lipper Fund Awards 2020 Switzerland event at the Park Hyatt in Zurich.

Second Macroeconomic Update on the Corona Crisis

Many investors feel reminded of exactly such forces by the unprecedented interventions of states and central banks around the Corona crisis as well as by the markets' reaction to it. We therefore analyze the fascinating and powerful mechanisms in the background and venture a systematic look at the risks of tomorrow. In doing so, our comprehensive update combines the latest research findings with the most burning issues in international monetary policy and the most exciting conclusions for investors.

A sustainable financial innovation

Finreon presented its new investment solution Finreon Carbon Focus® in September 2020. Simple, flexible and cost-effective decarbonization of portfolios, this is what the new range of solutions promises.

Carbon footprint neutralization with the Carbon Focus® Swap

The innovative portfolio construction of Finreon Carbon Focus® enables an efficient and complete neutralization of the carbon footprint of investment portfolios. Due to the patent-pending optimization algorithm, this neutralization leads to very little additional tracking error and thus low additional risks.

Read the article of the NZZ, Neue Zürcher Zeitung, on the topic "In investment portfolios, the climate target of 2050 can already be achieved tomorrow". (only available in German)

Economic Forum of the Association of Industry and Commerce Grenchen and Surroundings

On August 20, 2020, the Business Forum of the Grenchen and Surrounding Area Association of Industry and Commerce took place. Dr. Ralf Seiz was invited as "star guest" and in discussion with Reto Kohli, Dominik Blösch and Silvio Bertini on the topic "Financial documents in today's environment".

Read the article in the Grenchner Tagblatt, by Andreas Toggweiler. (only available in German)

Beyond Zero: Ways out of the monetary policy impasse - A joint client event by Acrevis and Finreon

On Wednesday, September 9, the annual joint customer event together with Acrevis took place. Due to the current Corona situation, the number of seats was limited. Nevertheless, we had the pleasure to welcome several customers to the event in St. Gallen. Dr. Ralf Seiz (CEO, Finreon) and Dr. Alexander Gruber (Head of Economic Research and Advisory, Finreon) presented as guest speakers on the topic Beyond Zero: Ways out of the monetary policy impasse.

The coverage ratio of pension funds is increasingly dependent on the stock markets

In the event of a crash, large losses occur. The development of the risk-bearing coverage ratio (RTDG) of Swiss pension funds depends (more and more) on the stock markets: A 1% decline in the global stock market causes the coverage ratio to drop by about 0.65%. Correspondingly, the Corona crash has led to large losses in the coverage ratio. In order to prevent major losses, the risk management of pension funds must focus primarily on the equity ratio.

Read the Finreon Update Deckungsgrad Schweizer Pensionskassen (only available in German)

Macroeconomic Update on the Coronavirus Crisis

CLOSED: The world stands still. Since the outbreak of the coronavirus crisis, we are experiencing historic times! Events on the markets are abundant: Entire countries are in lockdown; some industries are at a complete standstill; central banks are printing vast amounts of money; governments are putting together unprecedented rescue packages and even talking about helicopter money. In our macroeconomic update, we shed light on the fascinating background, provide interesting facts and describe the possible effects on the markets and on the economy.

Finreon donates to Kinderkrebshilfe Schweiz at Christmas

For this year's Christmas Finreon donates a contribution to the Kinderkrebshilfe Schweiz. With the donation we support the project "40 years / 40 pictures" by Boris Baldinger. We bought 10 pictures at the auction, which were donated to our customers and partners.

We are very pleased to be able to support Kinderkrebshilfe Schweiz through such a project.

Launch Finreon Premium Stable Income Fund

Finreon successfully launched the Finreon Premium Stable Income Fund on August 19, 2019 with initial investments of more than CHF 120 million, the first product from Finreon's new product range for high net worth individuals, family offices and foundations. The new White Fleet III - Finreon Premium Stable Income Fund enables private investors to invest like leading institutional investors

Click here for the solution

Read the news article at the online magazine Investment Europe. (only available in German)

Reduction of drawdown risks through factor diversification

Factor-based investing is becoming increasingly popular. Against this background, the debate about the performance characteristics of such approaches in different market environments has increased.

Read the article The Power of Factor Diversification by Wanja Eichl and Joachim Plath in STOXX's online magazine "Plus online".

Third academic Brown Bag seminar of Finreon and SIX

The third academic Brown Bag Seminar took place on February 26, 2019. We welcomed more than 80 participants from various renowned companies in the financial industry to this successful event at Au Prémier in Zurich. Once again, current academic papers from the field of financial market research were presented in a short and easy-to-understand format and made accessible to the participants. During the subsequent networking lunch, further lively discussions were held.

An interesting talk and a veritable success story from Finreon, STOXX and Credit Suisse

Multi-factor constructions are in vogue. They are designed to generate excess returns in all market phases. In a roundtable discussion, the protagonists Dr. Valerio Schmitz-Esser (Credit Suisse AG), Mr. Nico Langedijk (STOXX Ltd.) and Dr. Thomas Pfiffner (Finreon) discuss various aspects of innovation.

Read the article around the multi-factor solution EURO STOXX® Multi Premia®, in the Tages-Anzeiger. (only available in German)

Launch of EURO STOXX® Multi Premia® in cooperation with STOXX and Credit Suisse

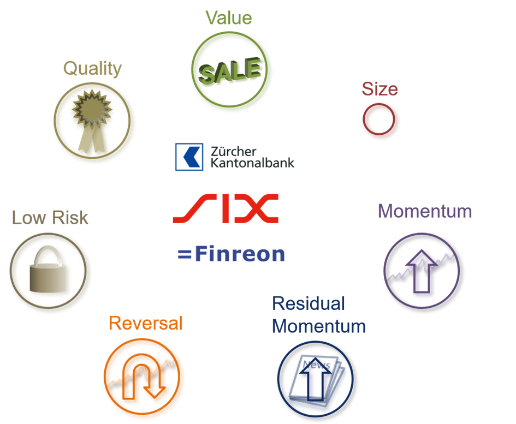

Finreon, together with STOXX, launches the official EURO STOXX® Multi Premia® Index, the new standard for factor-based investing on Eurozone equities. The new CSIF (Lux) Equity EURO STOXX® Multi Premia® Fund is suitable for investors who want to invest in a broadly diversified way in seven scientifically based factor premia in the eurozone equity market.

Read the presentation online here. (only available in German)

Dr. Ralf Seiz is once again one of the most renowned economists in Switzerland

Dr. Ralf Seiz is ranked eighth in the new NZZ ranking of the most influential economists in Switzerland. The NZZ ranking includes scientific importance as well as perception in politics and presence in the media. This means that the charisma of an economist in public debates is also measured and not just the pure research ranking.

Read the NZZ ranking article here. (only available in German)

Launch of the Finreon Fixed Income Risk Control® USD Aggregate Fund

Finreon launched two new funds on June 29, 2018. The Finreon Fixed Income Risk Control® USD Aggregate Fund enables the control of interest rate and credit risks with the proven Finreon Fixed Income Risk Control® methodology now also for USD-denominated bonds. With the Finreon World Equity Multi Premia® Fund, the successful Multi Premia® methodology is now also available on a global equity universe for all investors.

Read the fund details here.

Launch of the Finreon World Equity Multi Premia® Fund

Finreon launched two new funds on June 29, 2018. The Finreon Fixed Income Risk Control® USD Aggregate Fund enables the control of interest rate and credit risks with the proven Finreon Fixed Income Risk Control® methodology now also for USD-denominated bonds. With the Finreon World Equity Multi Premia® Fund, the successful Multi Premia® methodology is now also available on a global equity universe for all investors.

Read the fund details here.

Innovate2Invest 2018: Benefits of dynamic risk management and developments in multi-factor investing

Innovate2Invest 2018, an annual conference hosted by STOXX, took place in London on April 25, 2018. Nobel Laureate Myron Scholes presented on the topic of "Benefits of Dynamic Risk Management" and experts elaborated on developments in multi-factor investing during a panel discussion. Lukas Plachel from Finreon's Investment Solutions team participated in the event as a panel expert on multi-factor investing.

Watch the panel discussion here.

FACTOR ETFS: Exotics under the microscope

The range of factor indices and corresponding ETFs is growing steadily. This is a good time to take a look at selected individual factors and their performance - also in light of the price turbulence in February and March. The performance divergences are partly considerable, active product research remains essential.

Read here the article by Martin Raab in Payoff Magazine about, among others, the Swiss factor indices developed by Finreon. (only available in German)

Factor-based smart beta solutions

During periods of turbulent market movements, questions always arise. The risks in the field of factor-based smart beta solutions is one of them: can investments, which are often accused of lacking human steering, be trusted?

Read the article from "Banco - le magazine suisse de l'asset management". (only available in French)

SPI Size Premium Index- Winner of best performing Indextracker Product (Swiss Derivative Awards, 2018)

On March 22, 2018, the Swiss Derivative Awards were presented for the thirteenth time at an evening event at AURA Zurich. In the index products category, the experts were particularly taken with the PRPREZ tracker certificate on the SPI® Size Premium CHF (TR) Index of Zürcher Kantonalbank.

The jury and the audience therefore recognized Zürcher Kantonalbank's tracker certificate on the SPI® Size Premium CHF as the best index product in 2018.

SPI Single Premia Index - Which piggy bank would you like?

The seven factors of the Single Premia indices include size, value (low priced stocks), momentum (systematic trends) or low risk (safe stocks). However, exploiting such added values is not a simple matter. It requires a fundamental understanding of the isolated factors, combined with strategic decisions about the timing of the choices made. Only then will semi-active indices succeed in outperforming traditional passive indices.

Read here the article by Dieter Haas about the ZKB Tracker Certificates, which are based on our SPI Single Premia Indices. (only available in German)

Seven strategies instead of one reference index

Anyone who invests in the Swiss Market Index (SMI) puts 60% of their weight in the three heavyweights Nestlé, Novartis and Roche. In the broader Swiss Performance Index (SPI), their total mass is still 49%. Such an investment is poorly diversified and inefficient, critics complain. Stock indices with a different weighting offer an alternative. One sophisticated variant is the SPI Multi Premia Index. This index is supposed to perform better than the SPI over the long term, but it does not always succeed.

Read here the article of Philippe Béguelin which was published in the 41st issue of the newspaper Finanz und Wirtschaft. (only available in German)

Competition for active Swiss equity funds

The SPI Multi Premia® Index combines the seven SPI Single Premia Indices and enables a broad and diversified absorption of factor premiums. Since the beginning of September 2016, investors have been able to participate 1:1 in the price performance of the SPI Multi Premia Index via the CSMPBFA index fund.

Read the article by Dieter Haas on the Credit Suisse fund, which is based on our SPI Multi Premia index family. (only available in German)

Where do you look for yield in today's environment? (Le Temps, 2017)

In recent years, academic research has identified new sources of return, so-called factors, which can improve the performance characteristics of the portfolio. Factor-weighted benchmark indices implement these scientific findings by systematically exploiting the corresponding return drivers.

Read our article from Le Temps newspaper here (only available in French).

Launch of seven certificates on SPI Single Premia Indices®

The first fund on the SPI Multi Premia® Index has been trading on the Swiss stock exchange since fall 2016. Now, the product offering on the SPI Multi Premia® Index family has been expanded by seven open-end tracker certificates from Zürcher Kantonalbank. The tracker certificates, which have just been launched on the SIX Swiss Exchange, track the performance of the SPI Single Premia Indices® and thus enable investors to make targeted investments in the seven individual factors: Value, Size, Momentum, Residual Momentum, Reversal, Low Risk and Quality. The official SPI Single Premia Indices® of the Swiss Stock Exchange (SIX) each comprise 30 stocks with characteristics in line with the corresponding factor premiums. Within an SPI Single Premium, the securities are weighted according to their risk, so that all securities contribute equally to the risk (risk parity).

What sources drive stock returns?

What sources drive stock returns? - Diversification across multiple factors (Schweizer Personalvorsorge, 2016). Academic research has identified a variety of factor premia that can generate excess returns over the long term. However, investing in single sources of return is subject to the risk of long periods of underperformance. Systematic diversification across multiple return sources remedies this.

Read our article from the magazine Schweizer Personalvorsorge. (only available in German)

Learning Curve - Factor-based indices on Swiss equities (Payoff Magazine, 2016)

The Swiss Stock Exchange recently launched the SPI Multi Premia index family for factor-based investing. The eight new indices enable broader diversification and create additional return opportunities.

Read the article by Dieter Haas here, which was published in the December 2016 issue of Payoff Magazine. (only available in German)

Finreon expands Multi Premia® investment solutions with a defensive variant

With the launch of the Finreon World Equity Multi Premia® Defensive (Pension) Fund on September 29, 2016, Finreon adds a defensive variant to its Multi Premia® investment solutions. The Finreon Multi Premia® Defensive approach combines the risk reduction of a minimum variance portfolio with return optimization through systematic factor exposures. Investors are given an alternative to traditional equity investments, which either tend to carry higher risks, and bonds, or which offer little return in a low interest rate environment.

Click here for the solution

Finreon launches SPI Multi Premia® index series in partnership with SIX Swiss Exchange

As of September 13, 2016, Finreon launches the new index series SPI Multi Premia® together with SIX. The solution is based on systematic return drivers and features robust performance characteristics through a targeted diversification of these factors.

The launch of the SPI Multi Premia® index family at SIX Swiss Exchange will take place in the presence of Dr. Schmitz-Esser, Head of Index Solutions Credit Suisse, Werner Bürki, Member of the Management Committee of SIX, and Dr. Ralf Seiz, CEO of Finreon.

Finreon launches together with Credit Suisse and Credit Suisse Investment Foundation the investment group CSA BVG 25-45 Dynamic

As of April 28, 2016, Finreon launches the investment group CSA BVG 25-45 Dynamic together with Credit Suisse and Credit Suisse Investment Foundation. With dynamic risk management for a mixed portfolio, the new investment solution offers an innovative approach to the challenges of the current market environment. The solution is based on the proven cooperation between Finreon and Credit Suisse - while Finreon acts as an independent investment advisor in the area of risk management, Credit Suisse acts as the fund management company.

Finreon now offers the proven IsoPro® concept on sustainable stocks in the emerging markets

Finreon now offers the proven IsoPro® concept on sustainable stocks in the emerging markets. Sustainable investing is in vogue. There are many reasons for this, ranging from the avoidance of reputational risks to the active promotion of sustainable business practices. In the emerging markets in particular, there are major differences in the sustainability of companies - a sustainable investment strategy makes particular sense in this context.

Bonds become investable again with Finreon Fixed Income Risk Control®

In the low interest rate environment, Swiss investors are increasingly confronted with the fact that around 40% of the average asset allocation (bonds and liquidity) yields low or even negative returns. Moreover, these low returns come with high risks especially in the event of a rapid rise in interest rates - the asset class bonds has thus changed from 'risk-free return' to 'return-free risk'. With Fixed Income Risk Control, Finreon now offers a simple overall solution that systematically manages and hedges interest rate and credit risks without sacrificing the long-term return potential of bond investments: The goal is to make the asset class bonds investable again thanks to superior risk control.

Finreon IsoPro®: Outperformance in all markets

As a spin-off of the University of St. Gallen and as a long-standing think tank, it is our great pleasure to provide you with an update regarding the performance of our IsoPro strategies for equities at the beginning of the year. Since their launch, our IsoPro solutions have outperformed in all markets. IsoPro are rules-based, passively-oriented and broadly diversified strategies that are ideally suited for institutional equity portfolios. Since launch, all IsoPro strategies have outperformed their benchmarks and generated annual outperformance after costs.

Click here for the solution

Launch of the Finreon Tail Risk Control® 0-100 Fund

With the fund 'Finreon Tail Risk Control® 0-100', which was successfully launched on 29.11.2013, investors can also invest in the Swiss equity market in a risk-controlled manner and with a reduction of large asset losses. After the successful launch of the Finreon Tail Risk Control® (World) Fund in December 2012, which tracks the global equity market and already has AuM of > USD 440 million, the Finreon Tail Risk Control® 0-100 Fund was launched in response to numerous customer requests, which enables risk-controlled participation in the Swiss equity market. In addition, the Finreon Tail Risk Control® 0-100 Fund is the first opportunity for retail investors to benefit from the successful and proven Finreon Tail Risk Control® strategy.

Click here for the fund details

Launch of the Finreon World Equity IsoPro® Fund

The newly launched Finreon World Equity IsoPro® fund enables institutional investors to invest simply and flexibly in World ex CH equities, while avoiding the construction shortcomings of classic, market-weighted indices. A weighting independent of the market price, a broad diversification and the consideration of the risk of the individual stocks help the investor to achieve a higher and more robust return over the medium term. In addition to the Swiss equity market, the innovative Finreon IsoPro® methodology is now also available for the global equity market.

Click here for the fund details

Launch of the Finreon Tail Risk Control® (World) Fund

The recently launched equity fund 'Finreon Tail Risk Control® (World)' by the Swiss HSG spin-off Finreon has been successfully launched. By means of a risk-controlled management of the equity quota from 0 to 100%, an optimal utilization of the risk budget is ensured. The Finreon Tail Risk Control® (World) Fund enables the investor to manage the equity range in a risk-based manner and to continuously utilize the risk budget within a transparent and efficient solution. Especially among large institutional investors we see widespread interest in solutions to avoid large drawdowns

Click here for the fund details