Finreon lanciert gemeinsam mit der Credit Suisse und der Credit Suisse Anlagestiftung die Anlagegruppe CSA BVG 25–45 Dynamic

As of April 28, 2016, Finreon launches the investment group CSA BVG 25-45 Dynamic together with Credit Suisse and Credit Suisse Investment Foundation. With dynamic risk management for a mixed portfolio, the new investment solution offers an innovative approach to the challenges of the current market environment. The solution is based on the proven cooperation between Finreon and Credit Suisse - while Finreon acts as an independent investment advisor in the area of risk management, Credit Suisse takes over the portfolio management for the investment group.

The low interest rate environment is forcing investors to take on more risk in order to achieve an acceptable return, especially since risk-free asset classes are currently associated with negative returns. At the same time, with the increase in turbulence on the markets, investors are focusing more on risk management. While normal price fluctuations in the equity and bond markets can be well borne within a diversified portfolio, crashes and the associated losses in value pose a major problem for investors.

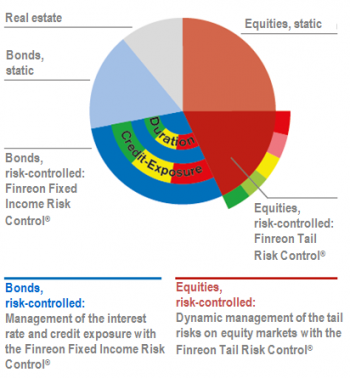

With the new CSA BVG 25-45 Dynamic investment solution, investors can benefit from the return potential of the individual asset classes in calm market phases thanks to dynamic risk management, while the risk of major asset losses in high-risk phases is reduced by systematic hedging. The CSA BVG 25-45 Dynamic investment group combines the advantages of active and indexed investment. The most important risks (equity, interest rate and credit risks) are systematically managed using efficient and risk-controlled modules.

The dynamic management of equity and bond exposure is based on proprietary risk indicators that measure the risks of major market dislocations on a daily basis using a variety of stress factors. The measured risks are reflected in the form of risk traffic lights.

Based on the proven Finreon Tail Risk Indicator, which measures the risk of a major loss of substance in the equity markets, the equity exposure is systematically managed on a rule-based basis between 25% and 45% (effective exposure taking into account the built-in reserve for rebalancing between 23% and 48%) (equities, risk-controlled). The risk-controlled management of the bond quota is based on the Finreon Fixed Income Risk Indicator, which systematically manages interest rate (duration) and credit risk (bonds, risk-controlled).

Through this risk management, the CSA LOB 25-45 Dynamic investment group makes it possible to benefit from the return potential of the equity and bond markets while controlling for large asset losses.

The main advantages of the CSA LOB 25-45 Dynamic investment group are summarized again below:

- The best of both worlds: The advantages of active, systematic risk management (Finreon) combined with the efficiency and transparency of passive solutions (Credit Suisse).

- Reduction of large asset losses: The risk-based management of equity, interest rate and credit risks is designed to reduce large asset losses.

- Higher return with lower risk: Through better utilization of the risk budget, a higher return can be achieved over the medium term with a lower risk input.

- Sensible innovation: Transparent, efficient and simple - risk-controlled management of a mixed portfolio in a single investment.

- Proven cooperation: Credit Suisse and Finreon work together for institutional clients with great success: Well-rehearsed processes and high interaction.

Here you will find detailed documentation on the CSA LOB 25-45 Dynamic investment group: